Supreme Court to Tackle Credit Bidding Rights in Chapter 11 Plans

On April 23, 2012, the United States Supreme Court heard oral argument on the issue of whether secured creditors have the absolute right to credit bid their secured claims in sales of encumbered assets pursuant to a chapter 11 plan. There is currently a split amongst the Circuit Courts of Appeal on this issue.

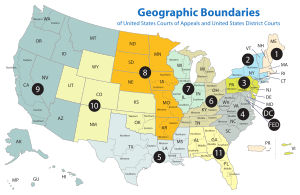

In In re River Road Hotel Partners, LLC, 651 F.3d 642 (7th Cir. 2011), the Seventh Circuit Court of Appeals recently upheld a lower court ruling denying confirmation of a chapter 11 plan because the plan proposed to sell encumbered assets free and clear of liens without allowing the lenders to credit bid their claims during the sale. A discussion of the River Road case is covered in an earlier blog.

The Seventh Circuit’s ruling was contrary to the decisions of the Fifth Circuit and Third Circuit Courts of Appeal in In re Pacific

Lumber Co., 584 F.3d 229 (5th Cir. 2009) and In re Philadelphia Newspapers LLC, 599 F.3d 298 (3d Cir. 2010). In those cases, both Circuit Courts found that, in lieu of including credit bidding rights, plans could be deemed “fair and equitable,” and thus confirmable, if they provided the secured lenders with “indubitable equivalent” value under section 1129(b)(2)(A)(iii) of the Bankruptcy Code (which sits in juxtaposition to clause (ii) of section 1129(b)(2)(A) and is separated from clause (ii) by the conjunction “or”).

As the issue is now ripe for an appeal, on December 12, 2011, the Supreme Court granted the River Road debtors’ petition for certiorari. In the appeal, the debtors point out that the text of section 1129(b)(2)(A)(iii) is unambiguous and permits a plan proponent to sell encumbered assets without providing for credit bidding, so long as the plan provides secured creditors with the indubitable equivalent value at confirmation. In contrast, the secured lenders argued that in drafting clause (ii) of section 1129(b)(2)(A) of the Code, Congress expressly protected a secured creditor’s right to credit bid when its collateral is being sold under a plan.

The Supreme Court will likely announce its decision by the summer. The awaited decision, which secured lenders around the country are closely monitoring, will assuredly impact the way that chapter 11 plans are structured in the future.